Revolutionize Liquidity and Guarantee Management with Adaptive Performance Based Intelligent System

Seamlessly manage liquidities, guarantee claims, loan portfolio and loan cycle management with AI Core system

Partners

Why Adaptive Performance-Based Transitional Liquidity and Guarantee Facility Management?

This system replaces rigid, guarantee-dependent lending with real-time risk assessment and adaptive liquidity management. By leveraging data analytics, machine learning, and responsive interfaces, it enables financial institutions to price loans based on borrower risk profiles rather than physical collateral, optimizing liquidity during transitional phases.

Services

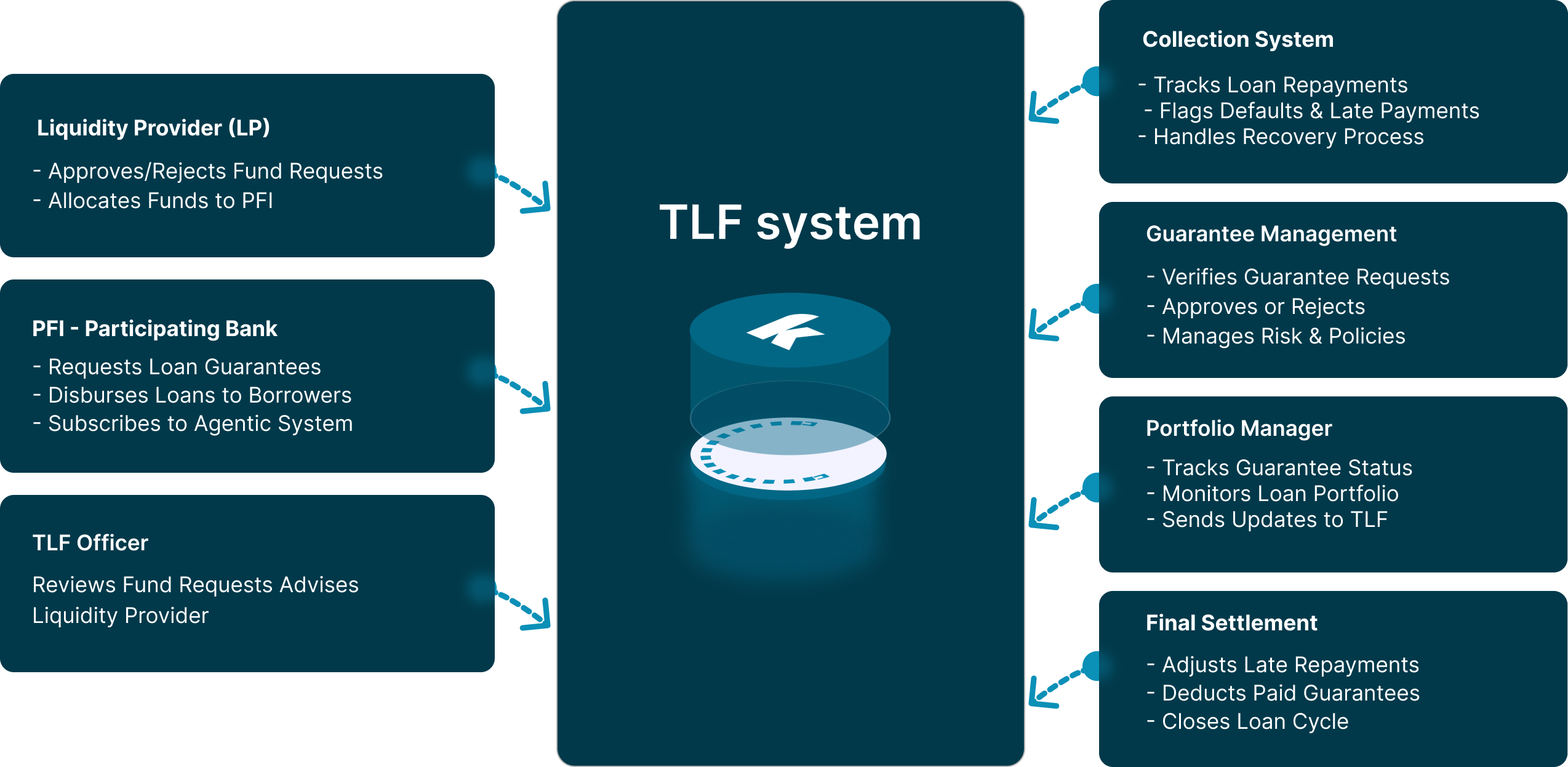

Liquidity Management

Facilitates and manages the flow of liquidity from funders to financial institutions while monitoring available funds.

Guarantee Management

Streamlines guarantee requests and claims from PFI’s and approvals by TLF and funders, reducing financial risk and ensuring timely payouts for defaulted loans.

Portfolio Manager

Provides real-time tracking of loans, guarantees, and financial performance, helping participating financial institutions assess risk and optimize fund allocation.

Early Warning System

Uses predictive analytics to detect potential loan defaults, enabling proactive intervention and reducing non-performing loans (NPLs).

Seamless Integration

Connects effortlessly with banking systems, credit bureaus, and risk management tools, ensuring real-time data exchange and automation.

Multi tenant services

Supports multiple TLF’s and financial institutions on a single platform with isolated data access, customized workflows, and centralized maintenance.

How It Works

Ready to elevate your liquidity and guarantee management?

Our globally distributed, auto-scaling, multi-cloud network will carry you from MVP all the way to enterprise. The industries' best trust us, and so can you.

Contact Us

Kifiya Financial Technologies

Addis Ababa, Ethiopia